An alternative to being a commodity

By Robert White November, 2014

We cannot solve our problems with the

same thinking we used when we created them.

- Einstein

Most products, services and solutions in the B2B space are perceived as commodities and are purchased on price regardless of their sophistication. If we don’t want them to be purchased that way we have to change the customers’ perception. That thought leads to two questions:

- Whose perception must we change?

- Once we have the answer to 1 we can then ask - change their perception to what?

Whose perception must we change?

Well – it can’t be line managers or ‘Procurement’ because they are required, and incentivised, to keep costs down when we want to talk about benefits. The only other place to go is up to the Executive level. Trouble is - their primary focus is on Profit. So we have to find a way to talk ‘profit’ – but it has to be a meaningful amount.

This is a ‘tough ask’ but if we could do it then the sales task becomes much simpler and quicker. So – let's assume for now that we can do it - then we know the answer to question 1 - our customer Executives.

Changing Customer Executive Perceptions - to What?

Well – we know we have to talk about ‘profit’ so the next question becomes: ‘In what ways and by how much do our products and services impact customer profitability?’

Actually – this isn’t such a hard question to answer although most companies have quantified less than 10% of their customer value. ('Value' is defined as 'the additional profit delivered to, and agreed by, your customer')

Pick a sector and a product – say – Mining – and Flexible Hose Assemblies (FHA) - though the product doesn't have to be this tangible. Here we find a lot of machinery operating in very hostile conditions in an environment where profit is only made if the cost per ton is kept below a critical limit.

So what happens to Production Costs and Revenue if FHAs are mismanaged? Well some of the more obvious things might be:

- Asset life is potentially shortened, leading to higher capital demands

- Lower ROCE

- More frequent and therefore higher planned maintenance costs

- Higher non availability of equipment

- More frequent equipment failures

- Potential for more environmental contamination events

- Potential for more Health and Safety events

- et al

All of these things impact Cost but, more importantly, they all impact production time which affects Revenue. In actual fact there are 88 things that impact customer profit associated with FHAs in this example.

From here it becomes possible to see how we could switch our conversation with customers from talking about ‘buying’ FHAs on a commodity basis to the effect that ‘mismanagement’ of FHAs has on customer profitability.

In other words it is possible to show Mine Executives how much of their profit is leaking through the ineffective management of ‘FHAs’ - a profit leakage that the FHA provider's solutions are designed to stop!

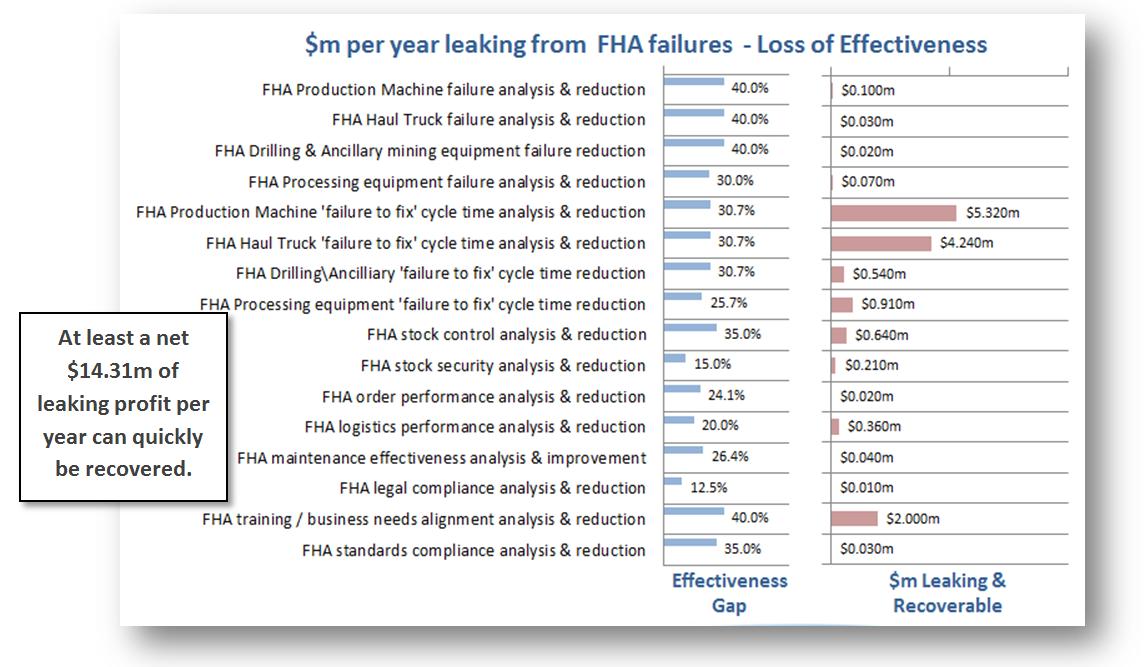

Ultimately it is possible to get to a chart like this one that shows the profit leakage associated with the ineffective management of FHAs within a Mine (real numbers).

Now – here’s the problem – your customer is probably completely unaware of the profit leakage and this means two things - you have first to ‘sell the problem’ and second, you must have a means of stopping the leakage i.e. a ‘Solution’.

‘Selling the problem’

Armed with a chart like the one above it becomes possible to call up an Executive of a potential customer(or even an existing customer) and say: “Our research is showing that, for mines similar to yours, about $14m of profit is leaking every year” (numbers will obviously vary from mine to mine).

You will get a meeting at least 80% of the time. The point of the meeting is NOT to talk about FHAs but to discuss the fact that your potential customer could be leaking $14m of profit and to explain how that could be.

Your only ‘call to action’ in this meeting is to enquire whether they would like to see what their numbers would look like since this would involve a very simple one day exercise.

The Executive usually says “yes” because this is really helpful information that he or she could not get any other way.

Provided that the profit leakage is large enough you have just created a fully quantified business case for fixing the leaks and this usually leads to an agreement in principle to do business.

Having a ‘Solution’

So – we can measure and agree the total profit leakage resulting from the poor management of FHAs (or any other product, service or solution however intangible).

We then align the vendor’s products and services to the leakage points. This allows the vendor to both define the optimal customer requirement (for any given customer) and, at the same time, make the business case for the customer to acquire the vendor’s solution(s).

This means that the vendor can sell in the maximum number of products and services that are both directly relevant to, and cost justified for, any given customer relative to closing off the customer profit leakage points.

This places the vendor, should it wish, in a position to supply and manage [FHAs] or whatever the solution is, for the customer over the long term – a role that is profoundly different from ‘selling product’.

It means long term relationships and a focus on driving customer profitability through effective value tracking mechanisms and continuous improvement programmes.

Conclusion

The alternative to being a commodity is to be, for your larger customers, the resident expert in the supply and use of your solutions with a clear focus on, and an ability to demonstrate delivery of, customer profit growth.

Robert White